Increases in Liability Accounts Are Recorded as Debits.

Increases in expense accounts are recorded as debits because they decrease the owners capital account true the normal balance side of an accounts receivable account is a credit. During the accounting period Jan-Dec 202 Mr Alex has already paid rent 10000 each month for 10 months.

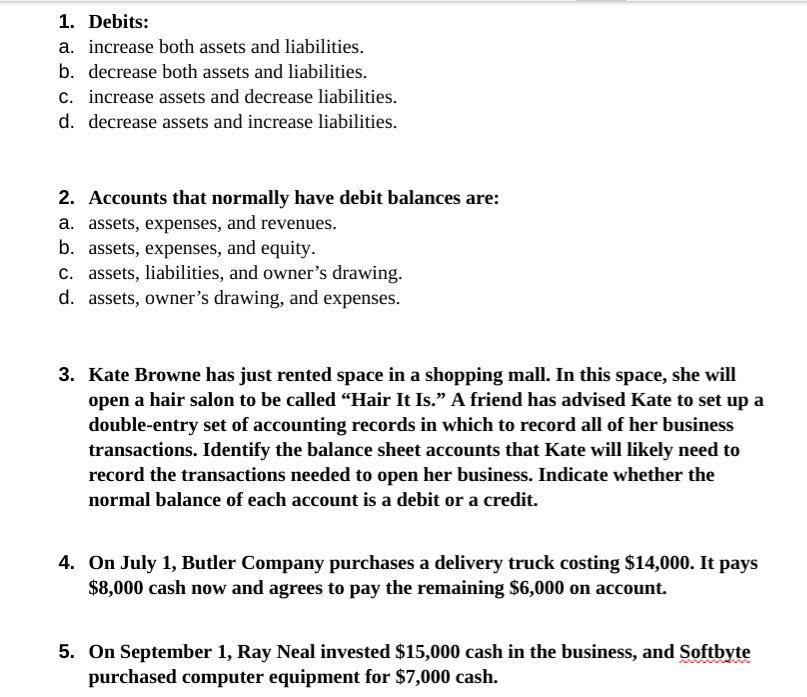

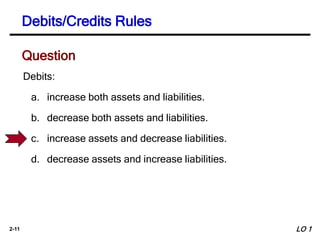

Solved 1 Debits A Increase Both Assets And Liabilities Chegg Com

True False 24A revenue account normally has a debit balance.

. For every credit there is at least two other credit entries according to double-entry accounting concepts. By definition the rules of debits and credits mirror the accounting equation. The rules for debits and credits for the balance sheet When an accountant is executing a transaction on the balance sheet of a company debits and credits are used to record which accounts are.

Credit means right side. You would debit inventory because it is an asset account that increases in this transaction and accounts payable is credited to a liability account that increases because the inventory was purchased on credit. Increases in liability accounts are recorded as debits.

Liability by Mr Alex. A bookkeeper credits a liability account to increase its value and debits the account to reduce its worth. ASSETS LIABILITIES EQUITY The accounting equation must always be in balance and the rules of debit and credit enforce this balance.

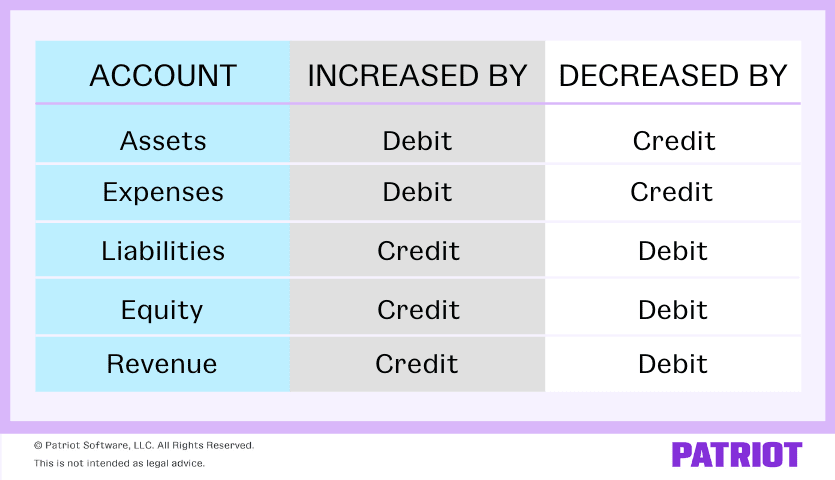

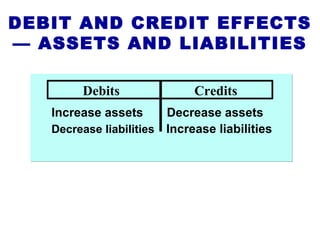

Decreases in liabilities are recorded as debits. A debit decreases the balance and a credit increases the balance. A debit increases the balance and a credit decreases the balance.

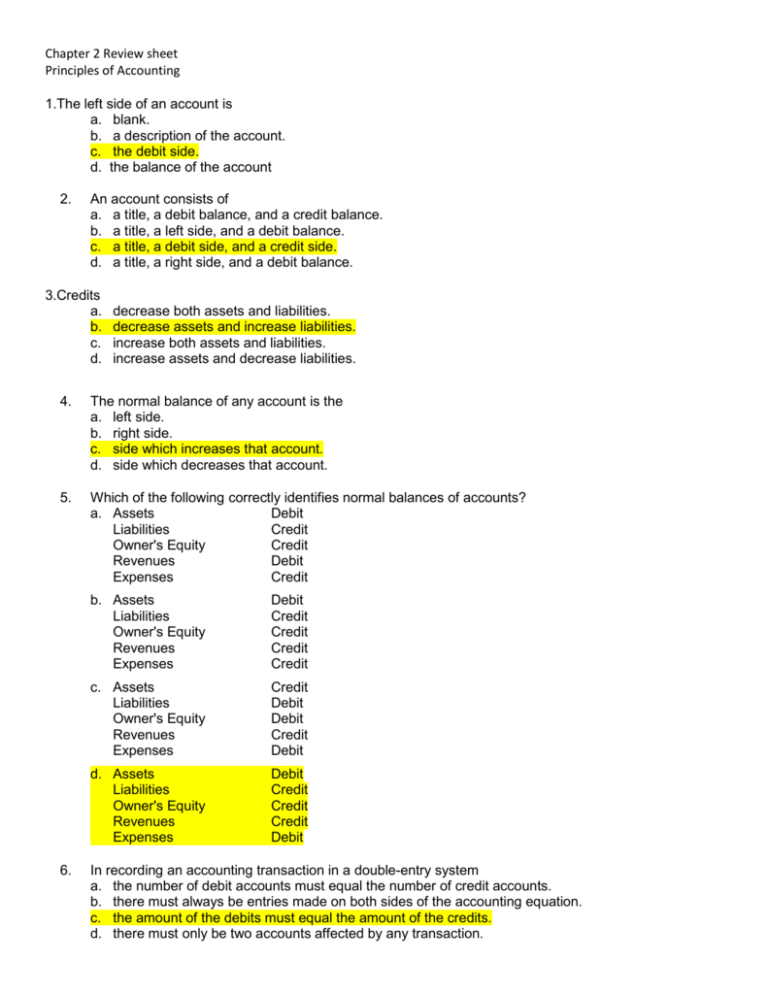

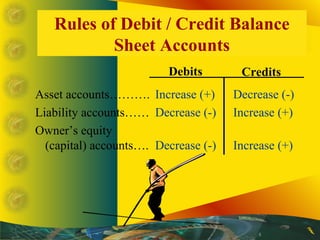

Which of the following statements about an account is true. The meaning of debit and credit will change depending on the account type. Debit and Credit Rules.

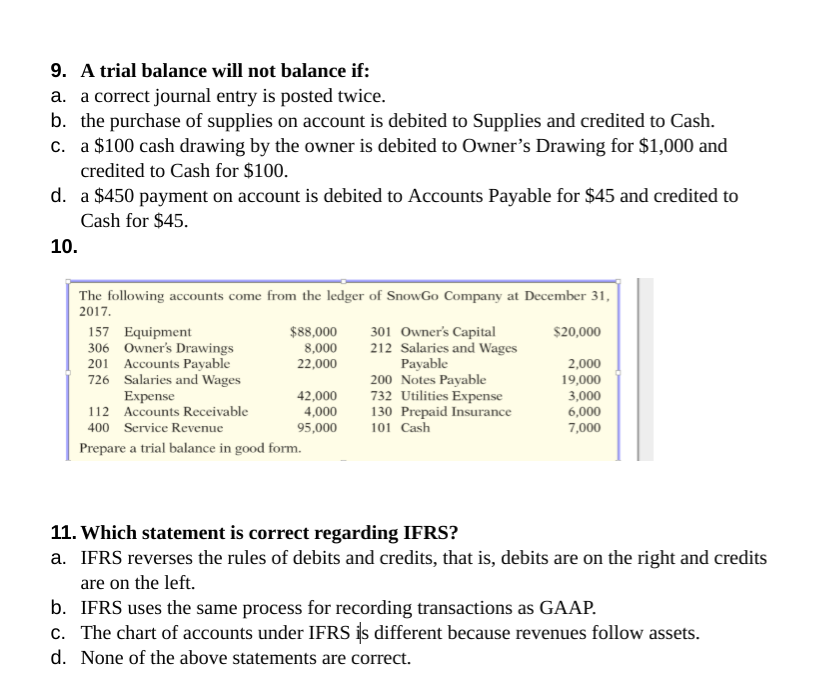

Im not sure if. Revenues liabilities account increases are recorded by credits Revenue account decreases are recorded by debits Drawing account decreases are recorded by credits A credit balance in. Accounting questions and answers.

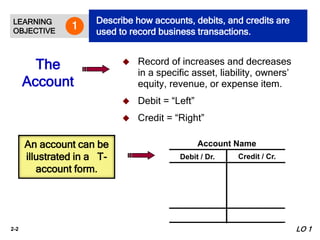

Assets Liabilities Stockholders Equity Stockholders Equity Accounts Asset Accounts Liability Accounts Capital Stock and Retained Earnings Debit Credit Debit Credit Debit Credit -- Debit Credit Debit Credit Debit Credit for for for for for for increase decrease decrease increase decrease increase Expense Accounts Debits Credits and Dividends Account. In which of the following types of accounts are increases recorded by credits. They do so by posting journal entries in general ledgers debiting and crediting financial accounts.

The balance of the account can be determined by adding all of the debits adding all of the credits and adding the amounts together. 3 The total number of shares outstanding is always equal to the number of shares authorized. In which of the following types of accounts are increases recorded by debits.

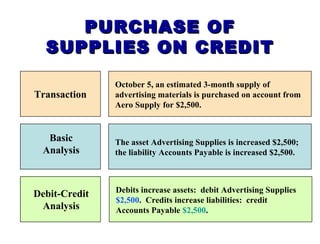

When a transaction is recorded a minimum of two accounts are impacted. Equipment is debited for 12000 and AP is credited for 12000. Modern rules of accounting states Credit the increase in liability Example.

Increases in liabilities are recorded as credits. Thus the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy. The accounts payable account is listed in the chart of accounts as an asset.

On January 31st company XYZ issues a sales invoice for 3000 worth of consulting services provided on account. Debits and credits are conduits through which bookkeepers convert economic events into valuable financial data that management can use. Assets Liabilities Equity.

2 When preparing the operating activities section of the statement of cash flows using the indirect method decreases in current assets are added back to net income. True False 23All increases and decreases in cash are not necessarily recorded in the Cash account. Liabilities are debts owed by the business entity.

Remember the accounting equation. Liability increases are recorded with a credit and decreases with a debit. These differences arise because debits and credits have different impacts across several broad types of accounts which are.

The right side of an account is the debit or increase side. 1 Increases in liability accounts are recorded as debits. O True False R Asset accounts are decreased by debits.

Increases in liability accounts are recorded as debits. There are but only one accounts for owners equity items. For liabilities and equity accounts however debits always signify a decrease to the account while credits always signify an increase to the account.

But he could not pay the rent for 2 months until the end of the period. True False 25Debits to accounts are normally decreases. TF 2 When preparing the operating activities section of the statement of cash flows using the indirect method decreases in current assets are added back to net income.

The cash account will always be debited. An account is an individual accounting record of increases and decreases in specific asset liability and owners equity items. Debit simply means left side.

We use the words debit and credit instead of increase or decrease. 22Increases in liabilities are recorded as debits. In fundamental accounting debits are balanced by credits which operate in the exact opposite direction.

Accountants record increases in asset expense and owners drawing accounts on the debit. TF 3 The total number of shares outstanding is always equal to the number of shares authorized. So rent 20000 is still payable ie.

This is the opposite debit and credit rule order used for assets. The asset Equipment increases at a cost of 12000 and a liability Accounts Payable AP of 12000 also increases.

One App Accounting Small Business Accounting Startup Infographic

Does Debit Increase Liabilities Ictsd Org

Types Of Accounts In Accounting Assets Expenses Liabilities More

After Studying This Chapter You Should Be Able To Chapter 2 The Recording Process 1 Explain What An Account Is And How It Helps In The Recording Process Ppt Download

Double Entry Accounting Accounting Basics Learn Accounting Accounting Student

Chapter 2 1 Chapter 2 2 Chapter 2 The Recording Process Accounting Principles Ninth Edition Ppt Download

Liabilities Increase On The Debit Side Ictsd Org

Debits And Credits Accounting Notes Accounting Financial Accounting

Accounting Principles 12th Edition Ch2

Accounting Principles Eighth Edition Ppt Download

Accounting Principles 12th Edition Ch2

Debits And Credits Accounting Play

Introduction To Accountingch02

Introduction To Accounting Accounting Education Information Accounting Student

Debits And Credit Cheat Sheet Debit Business Increase Revenue

Introduction To Accountingch02

Solved 1 Debits A Increase Both Assets And Liabilities Chegg Com

Comments

Post a Comment